What is a Spanish Golden Visa?

The Spanish Golden Visa Program is one of the most popular residency options for foreigners worldwide looking to start a new life in Spain, with over 7,425 active Golden Visa holders in the country as of 2021. This permit is also known as the investor’s residency, designed for individuals from outside the European Union who wish to make a substantial investment in Spain to obtain residency in the country.

Initially, this permit allows you to live and work in Spain for three years, with the possibility of renewal for an additional five years as long as you maintain your original investment. This type of visa primarily involves investment in real estate.

Having an investor’s visa grants you the freedom to travel throughout the European Union. Hence, if you obtain the Golden Visa in Spain, you will certainly have the opportunity to explore the rest of Europe.

Corresponding Law

The specific law that governs the investor residence permit in Spain is the 14/2003 Entrepreneur’s Law and not the Spanish Immigration Law. The distinction between the two is crucial, because it impacts the application process and future renewals.

For instance, unlike permits obtained through the General Immigration Regime, the investor visa allows you to apply directly from Spain.

The Institution Responsible for Reviewing Your Application

The Spanish Golden Visa operates under the Entrepreneur’s Law, a legislation established in 2013 to foster talent and investment in the country. This law encompasses various residency authorizations, including the Investor Visa, Entrepreneur’s Visa, Intra-corporate Transfer Visa, and Highly Qualified Worker Visa.

Therefore, rather than having each application processed by local immigration offices, your investment visa file would be handled by the UGE (Large Business Unit). While physically located in Madrid, applications can be submitted online.

Spanish Golden Visa Application Process

Obtaining the Golden Visa is simple and straightforward compared to many other residency permits for non-Europeans that require complex and time-consuming procedures. The Spanish Golden Visa stands out for its efficiency and simplicity, making it an attractive option for investors.

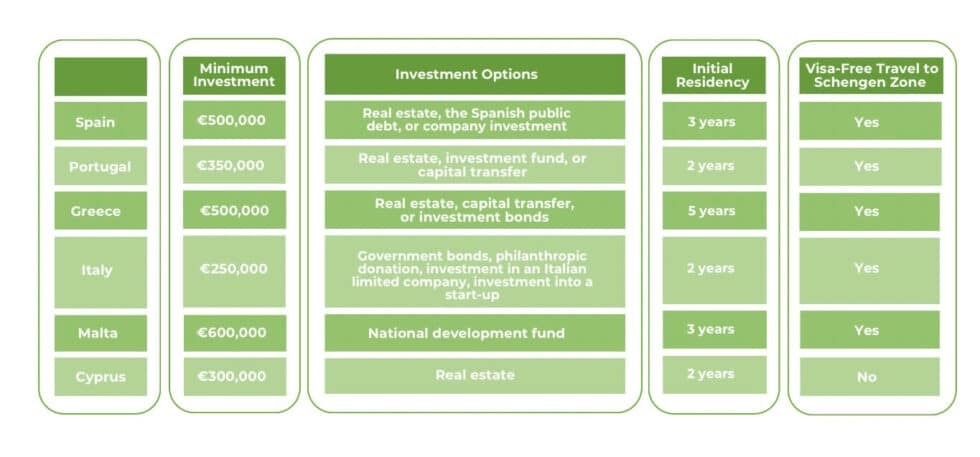

While other European countries also offer similar programs, the Spanish Golden Visa is particularly the best option due to its speed and convenience. Several factors such as investment requirements, preferred sectors for investment, and associated terms and conditions are crucial when considering different options. However, given the robustness of the Spanish real estate and the overall appeal of Spain as a destination, the Spanish investor permit emerges as the top choice.

To assist in making an informed decision, have a look at the following table for a detailed comprehensive comparison of EU Golden Visas:

Requirements for Investment in Spain

To invest in Spain, a foreigner requires a Non-Resident NIE (foreign identity number). This NIE is indispensable for any legal or economic transaction within the country, including property investment.

It can be obtained from one’s home country by justifying the intention to invest or buy property. It is important to note that the NIE serves solely as an identification and differs from the TIE (Foreign Identity Card), which grants residency rights for living and working in Spain as an expatriate.

Who Qualifies for a Spanish Golden Visa?

To be eligible for a Spanish Golden Visa, applicants must meet the following criteria:

- Not a citizen of the European Union.

- Of legal age (18 years or older).

- Have a clean criminal record, both within Spain and in any other country of residence over the past5 years.

- Have full-coverage healthcare in Spain, which must be obtained through either public or private insurance.

- Travel insurance or coverage from the applicant’s home country is not accepted

- Demonstrate sufficient financial means to support themselves and their family (if applicable) during their residency in Spain

- Make the required investment (either 500,000, € 1M, or € 2M depending on the chosen route) and provide documentation proving the investment

Investor Permit Benefits

The permit acts as a gateway to numerous benefits in the country. Below are the key advantage of the investor visa in Spain:

- It not only grants residency but also permits work in Spain. The golden residency serves as a gateway to obtaining a work permit, enabling individuals to establish their own businesses or work for others.

- It is the only residence permit that provides initial authorization to live and work in the country for a duration of 3 years, whereas other permits typically allow for only 1 year.

- The Golden Visa requires the applicant to visit the country only once per year, avoiding tax residency and resulting in tax savings.

- It allows unrestricted movement within the Schengen area, encompassing most European Union countries.

- Families can easily join the investor in Spain. The investor can apply for residency for their partner or children through a joint application, making it an ideal choice for families looking to relocate. It is important to note that for children, they must be under 21, enrolled in studies, or financially dependent on the investor.

- The application process for the golden visa does not require the applicant to be physically present in Spain. Instead, they can designate a representative to collect the necessary documentation on their behalf.

Spanish Golden Visa Rules

The cost of obtaining a Golden Visa in Spain varies depending on the chosen investment option, with minimum thresholds set at €500,000, €1 million, or €2 million.

Investors appreciate the flexibility of investment options beyond real estate, including:

- Purchasing a property valued at more than €500,00. However, in cases where the property is purchased, the investment is calculated at the individual level unless the marriage is registered under a community property regime. If the personal contribution to the property doesn’t meet €500,000, visa eligibility may be affected.

- Acquiring shares from a Spanish company or holding a bank deposit in a Spanish entity valued at over €1 million.

- Investing €2 million or more in Spanish public debt securities.

- Investing in a business project to be developed within Spanish territory, which must meet specific criteria such as generating employment, contributing to scientific/technological advancement, or having a significant socioeconomic impact.

Aside from the initial investment, applicants should consider additional costs, particularly taxes associated with property purchases. Taxes are an inevitable aspect of most societal transactions, including property acquisition.